In July of each year I have recorded the Grcery Market Share of leading retailers in Great Britain as shown by Kantar data. This has been going on since 1997 and I have mentioned this series in this blog before (e.g. last year)mentioned this series in this blog before (e.g. last year). As we have all commented, this year is like no other and as the July point is based on sales over the last 12 weeks, the July data this year, are especially interesting.

The first figure below shows the raw Kantar data for this year, by retailer and compared to last July. It is worth going to the original source and having a play around with the timeline.

It is worth noting some obvious points about the sector. The last few months have seen a big rise in food retail sales (Kantar says up 17% over the last 12 weeks). Online sales within that have grown remarkably, such that Ocado is the fastest growing retailer in this series (and the M&S tie-up is yet to come). Online grocery market penetration (proportion of total sales) has almost doubled from 7.4% to 13% since March, and this growth has been limited by capacity constraints. We are also well aware of the focus on local and convenience during the lockdown and whilst there is some evidence of this now trending down, over the period reported here, the Co-operatives are up 31% year on year and symbols and independents are up 60%. Frozen food, and here Iceland is notable, has also been a very strong performer.

The figure above thus shows the leading players all losing market share (and this includes Aldi but not Lidl) with the growth being in the Co-operatives, Iceland, Ocado and symbols/independents. Asda performed the poorest of the big 3, probably due to its lower exposure to the small convenience sector.

The second figure below provides the long-run data since 1997 for the big 3 and more recently the discounters. The decline of Asda and the reversal for Aldi are the newer stories here. The long-term trends remain the same broadly, but Asda and Aldi must be hoping this current period is a blip. Certainly for Asda, the decline is not great news at a time when they are looking to be sold off by Wal-Mart. Conversely, those strong in local markets may be hoping that this localisation “sticks” and that their performance in store and in home delivery may cause some consumers to rethink their pre-pandemic behaviours.

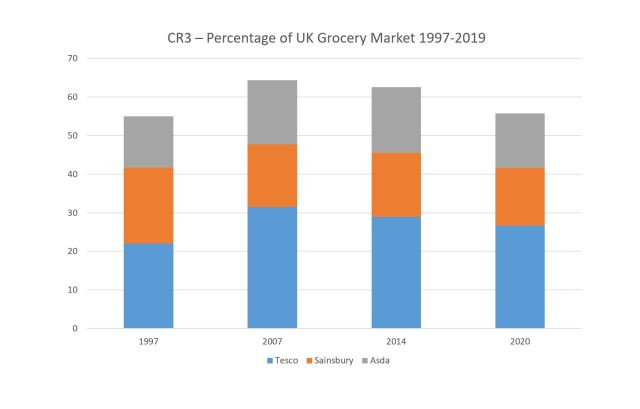

Finally, and as also done last year, I present the CR3 percentage i.e. the percentage of the UK market taken by the top 3. In 2007, this reached a peak under this measure of 64.3%. This year it is 55.7% – a large decline from 57.4% last year and continuing the recent sharp downward trend – and is now getting close to where it was in 1997. Concentration has been reversing, and the “remaining” 45% is now more diverse than it was in 1997.

Pingback: 2020 on the Blog – a reflection | Stirlingretail

Pingback: Grocery Market Shares in GB 1997-2021 | Stirlingretail

Pingback: 2021 : the stirlingretail.com year in retrospect | Stirlingretail

Pingback: Grocery Market Shares in Great Britain (GB) 1997-2022 | Stirlingretail

Pingback: 2022: the stirlingretail.com year in retrospect | Stirlingretail

Pingback: 2022: the stirlingretail.com year in retrospect - Pioneer News Limited